Advisors Financial Asheboro Nc for Dummies

Wiki Article

All about Financial Advisor

Table of ContentsFascination About Financial Advisor FeesThe Ultimate Guide To Financial Advisor LicenseThe Ultimate Guide To Financial Advisor DefinitionFinancial Advisor Salary Fundamentals Explained

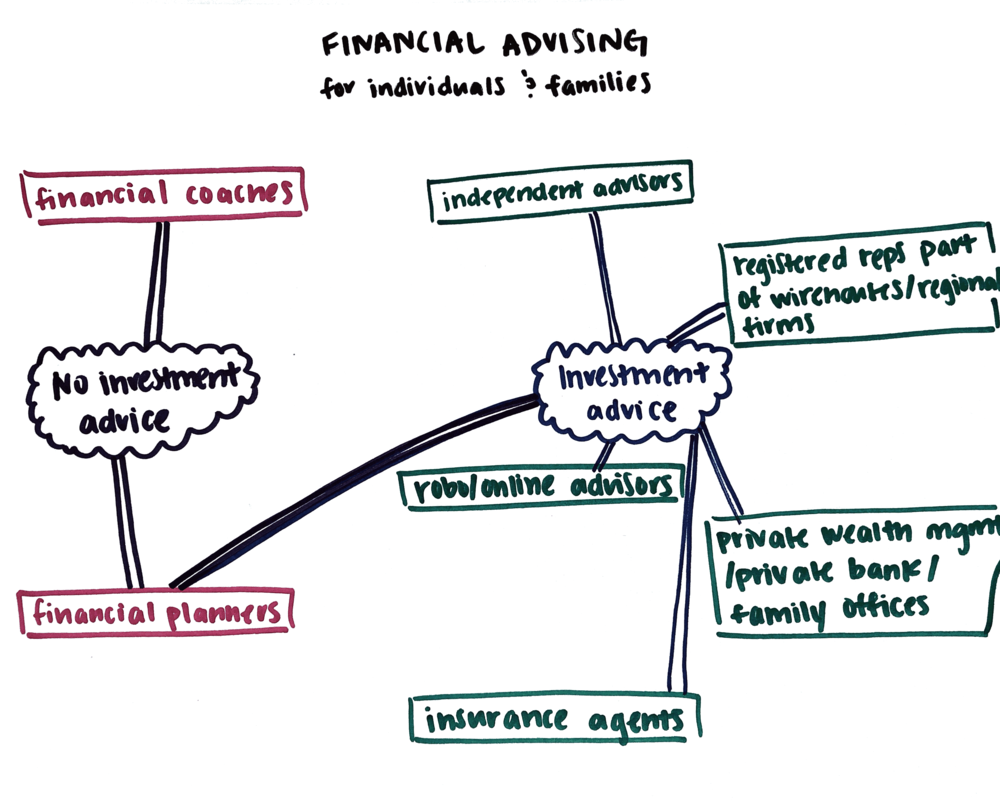

There are numerous types of economic consultants around, each with differing credentials, specialties, and also levels of liability. And also when you're on the quest for an expert matched to your requirements, it's not uncommon to ask, "How do I understand which financial advisor is best for me?" The solution begins with a straightforward accountancy of your demands and a bit of research.Kinds of Financial Advisors to Consider Depending on your monetary needs, you might choose for a generalized or specialized monetary consultant. As you start to dive into the world of seeking out an economic advisor that fits your needs, you will likely be provided with lots of titles leaving you questioning if you are speaking to the ideal person.

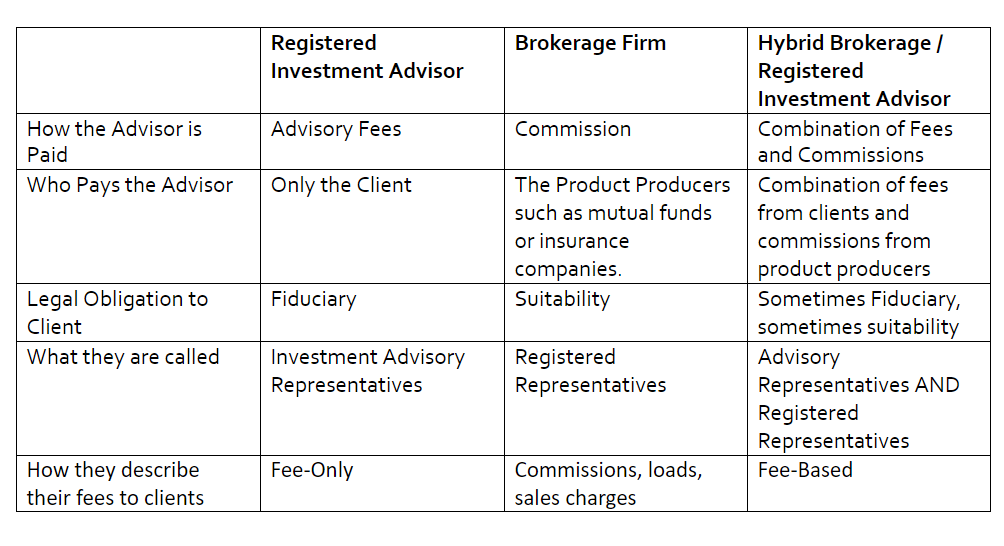

It is essential to keep in mind that some monetary consultants additionally have broker licenses (meaning they can sell securities), but they are not solely brokers. On the very same note, brokers are not all accredited equally and also are not financial consultants. This is just among the numerous factors it is best to begin with a certified monetary planner who can suggest you on your financial investments as well as retired life.

The Best Guide To Financial Advisor Magazine

Unlike financial investment consultants, brokers are not paid directly by clients, rather, they make commissions for trading stocks and also bonds, and for offering shared funds and also various other items.

A recognized estate coordinator (AEP) is a consultant that specializes in estate planning. When you're looking for a financial consultant, it's good to have an idea what you desire help with.

Just like "monetary consultant," "economic planner" is likewise a broad term. Somebody keeping that title might likewise have other accreditations or specializeds. Regardless of your specific needs and also monetary circumstance, one standards you need to strongly consider is whether a prospective advisor is a fiduciary. It may stun you to discover that not all financial advisors are called for to look at this now act in their clients' benefits.

An Unbiased View of Financial Advisor Jobs

To secure on your own from a person who is just trying to get even more money from you, it's a good idea to search for a consultant who is registered as a fiduciary. A financial consultant that is registered as a fiduciary is called for, by legislation, to act in the ideal interests of a customer.Fiduciaries can only suggest you to utilize such items if they think it's actually the very best economic choice for you to do so. The U.S. Stocks as well as why not check here Exchange Commission (SEC) manages fiduciaries. Fiduciaries that stop working to act in a client's benefits might be struck with fines and/or jail time of as much as ten years.

That isn't since any person can get them. Receiving either accreditation requires a person to experience a range of courses and also examinations, along with earning a set quantity of hands-on experience. The result of the certification procedure is that CFPs as well as Ch, FCs are fluent in topics across the area of individual financing.

The fee might be 1. Costs go to this website usually decrease as AUM rises. The alternative is a fee-based consultant.

3 Simple Techniques For Financial Advisor Job Description

An advisor's management cost might or might not cover the costs linked with trading securities. Some experts also bill a set charge per deal.

This is a solution where the advisor will certainly pack all account management prices, including trading charges as well as expense proportions, into one comprehensive cost. Because this fee covers extra, it is usually more than a cost that just consists of administration and excludes things like trading prices. Wrap costs are appealing for their simplicity however likewise aren't worth the cost for everyone.

While a standard advisor usually charges a charge in between 1% and 2% of AUM, the fee for a robo-advisor is usually 0. The huge trade-off with a robo-advisor is that you often don't have the capacity to chat with a human expert.

Report this wiki page